- Clipping

- Market roundup: Brazil’s rising tide of bankruptcy protection

Market roundup: Brazil’s rising tide of bankruptcy protection

Default rates are at record highs, and financing opportunities for Brazilian companies are deteriorating sharply due to the elevated level of interest rates

- The dashboard: Brazil’s benchmark stock index Ibovespa went down by 5.41 percent this week. Meanwhile, the Brazilian Real gained 2.93 percent against the U.S. dollar.

- Biggest gains: CVC (tourism): +18.77 percent.

- Biggest drops: Minerva (meat processing): -6.52 percent.

Bankruptcy protection filings up 38percent in Q1 2023

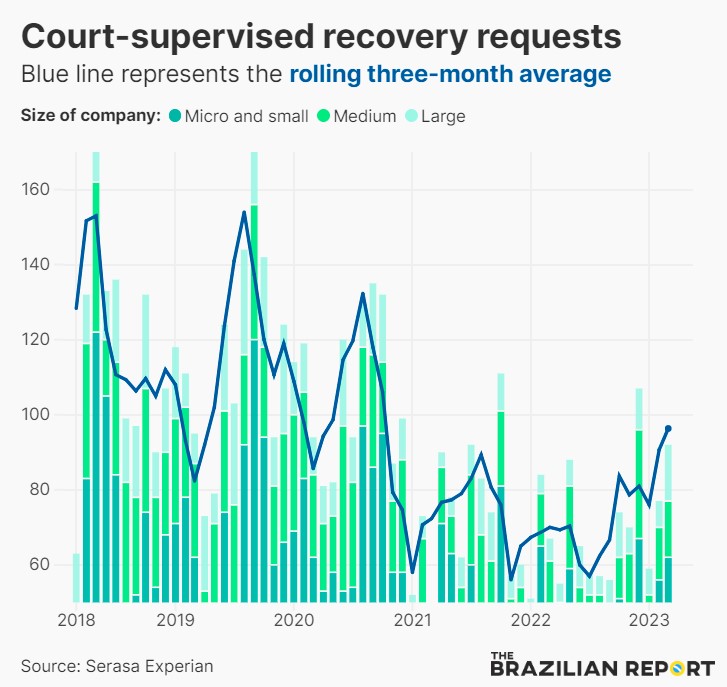

In the first quarter of this year, 289 Brazilian companies filed for bankruptcy protection, up 37.6 percent from the same period in 2022,according to data from Serasa Experian, Brazil’s largest credit bureau. It’s the highest level in five years.

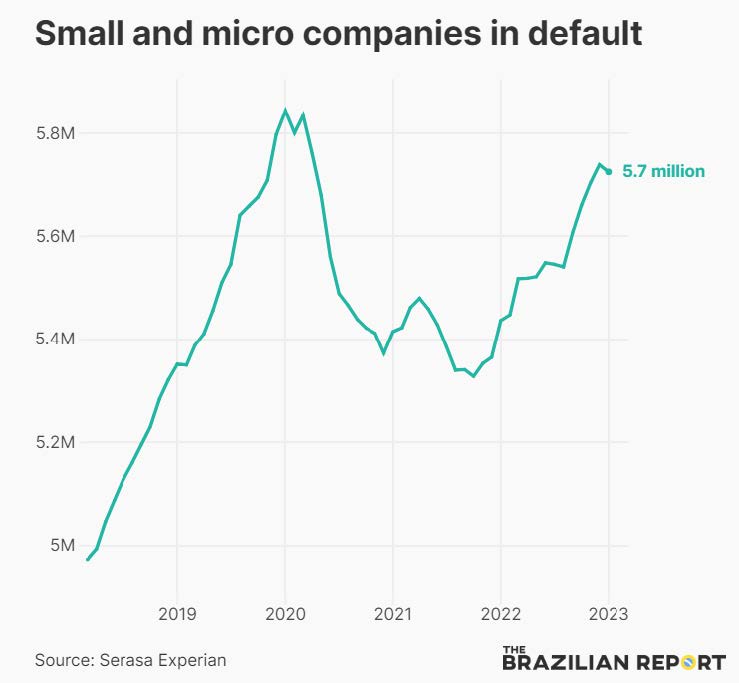

Why it matters. Micro and small businesses account for more than 20percent of bankruptcy protection filings, a trend that is expected to grow in the coming months. In addition, default rates are at a record high, with 6.5 million businesses unable to pay their debts and secure new lines of credit — nearly 90 percent of which are SMBs.

Backbone. Businesses are considered micro and small when they post revenue up to BRL 4.8 million (USD 977,560) a year. They are the heart of the Brazilian economy and account for eight out of every ten formal jobs created in the country, mostly in the services sector.

Yes, but … The number of large companies, such as giant retailer Americanas and telecom operator Oi, resorting to court-supervised recovery has also increased, accounting for 35 of the requests filed between January and March, up from 18 in last year’s first quarter.

- According to Serasa economist Luiz Rabi, “when the number of requests for judicial reorganization and bankruptcy protection increases among large companies, it turns on a warning alert, as they would have greater capacity to cross these uncertain economic scenarios.”

Downhill. With the deterioration of default levels, which according to Serasa’s data has been increasing since September 2021, it was inevitable that companies would reach this level of requests for bankruptcy protection.

- Even if the level of late payments by these companies slows down, the number of companies entering insolvency will increase

- Bankruptcy filings also increased, from 69 in March 2022 to 97 in the same month in 2023, a 40.6 percent increase.

It’s expensive to go bankrupt. Court-supervised recoveries are taking nine to 15 months to reach the creditors’ meeting stage. “And even after having the plan approved by the judge, there are companies that take years to get out of this process, even though Brazilian law determines a period of two years for this,” observes Laura Bumachar, a lawyer specializing in bankruptcy protection and arbitration, and a partner at law firm Dias Carneiro Advogados.

- In addition, judicial administrators can charge up to 5 percent of the debt amount, not including the costs of lawyers and consultants to restructure the business.

- “The truth is that many [businesses] are bankrupt or close to it, and there are not enough consultancies and law firms to serve everyone. The costs of legal proceedings are high and time-consuming. Inevitably we will see more companies going bankrupt this year,” says Luis Alberto Paiva, founding partner of Corporate Consulting.

How they got here. Last year, analysts predicted a milder scenario for2023, with the Central Bank cutting Brazil’s benchmark interest rate in the medium term. Many companies began to opt for post-fixed loans pegged to the local interbank deposit certificates rate, known as CDI.

- However, with the Selic rate remaining high for longer than expected, debt and credit became more expensive, pressured by shorter maturities.

By the numbers. Brazil’s benchmark interest rate has risen from 2percent to 13.75 percent since March 2021, but the cost of raising funds for companies is much higher.

- “No business today gets working capital from banks for less than 2percent interest per month, which means 24, 25 percent interest per year. If the company resorts to lines such as overdrafts, then costs rise to 15 percent a month easily. It’s totally unsustainable,” stresses Mr. Paiva.

- “Nearly half of the corporate sectors we track have asset returns below the effective credit rate. You can count on your hands the companies managing to generate returns for shareholders; they are from industries linked to commodities that had a price boom last year,” said Diego Ocampo, senior director and corporate sector leader for S&P Global Ratings in Latin America, in a podcast this week.

Worst yet to come. Even if the Central Bank starts cutting interest rates in the second half of the year, the effects won’t be felt until late this year or early 2024.

Matéria Publicada por The Brazilian Report

Outros Clippings

2021 - Corporate Consulting ![]() Todos os Direitos Reservados | Política de Privacidade

Todos os Direitos Reservados | Política de Privacidade

Serviços

Serviços Gestão de Crises e Reestruturação

Gestão de Crises e Reestruturação